Underwriting, Upgraded

5 Ways Vexcel Shortens the Path from Submission to Smart Decision

Insurance underwriting has always been a balancing act: the need to evaluate risk quickly while ensuring every detail is accurate. Yet many underwriters find themselves bogged down in manual reviews and incomplete data. In fact, McKinsey reports that underwriters spend 40% of their time on administrative tasks, leaving less than half their day for actual risk analysis. That inefficiency doesn’t just slow down business—it exposes insurers to premium leakage and costly blind spots.

Vexcel is changing that story. By bringing together high-resolution aerial imagery, AI-derived property attributes, and a vast historical archive, Vexcel helps underwriters cut through the clutter at the moment of submission. The result? Faster reviews, fewer errors, and smarter portfolio growth.

Here are five ways Vexcel streamlines the underwriting process.

Instant Property Validation

Submissions often arrive with outdated or incomplete details. Was that roof replaced last year? Does the property include an unreported pool? Missing items at submission lead to undervalued policies and premium leakage. In U.S. commercial property lines alone, misclassification of construction class or fire protection is estimated to cause $4.5 billion in leakage over the next four years. Broader industry studies attribute billions more annually to omitted exposures and incorrect classifications across property and casualty lines.

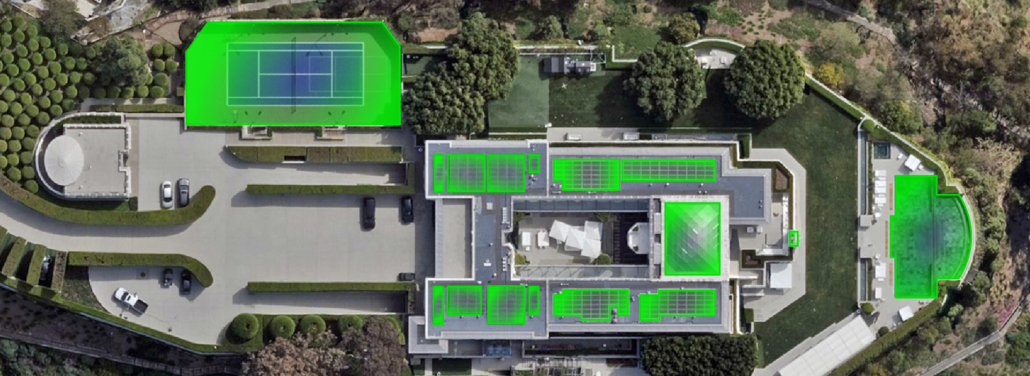

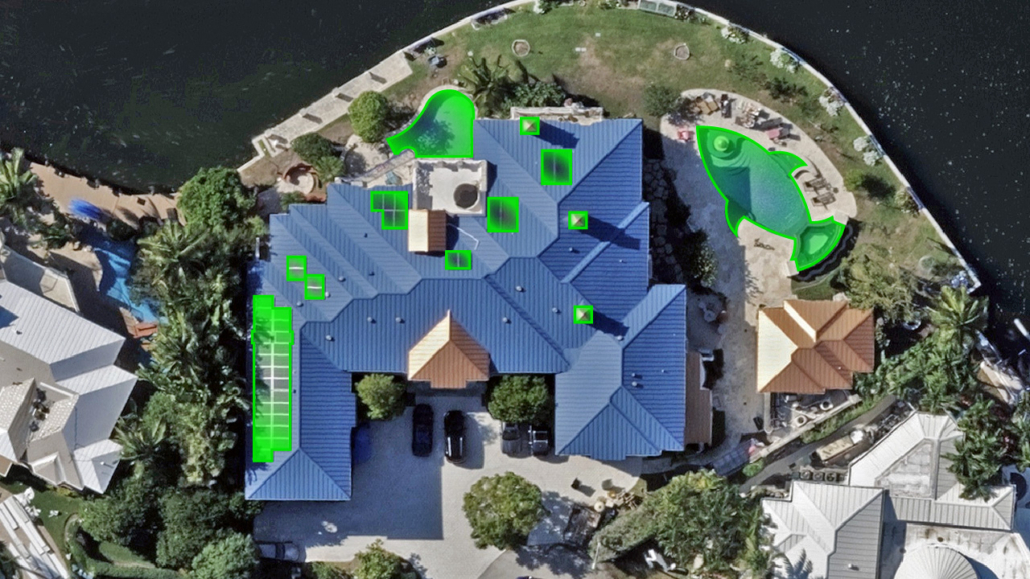

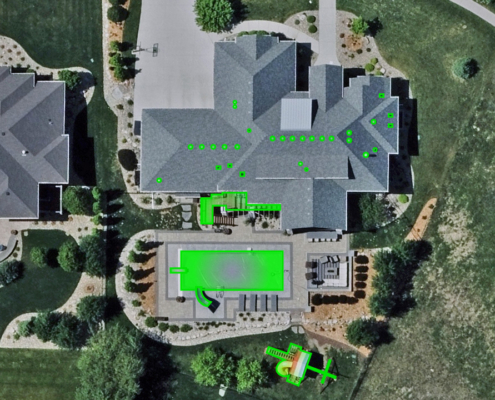

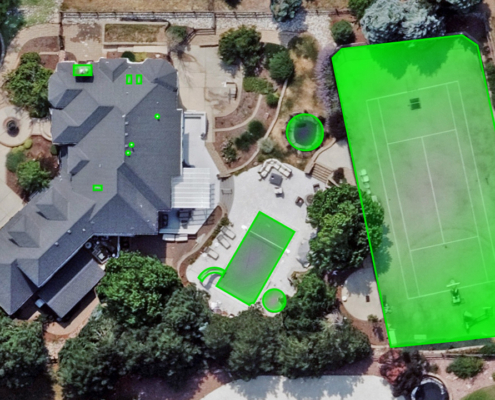

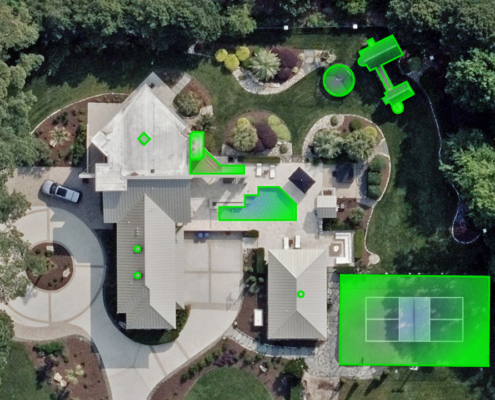

With Vexcel’s Ortho, Oblique, and Multispectral imagery, underwriters can validate property details in seconds. Understand that first look on a property to better flag risks or discrepancies, closing the gap between what’s declared and what’s real.

Faster Reviews, More Submissions

Speed matters. Automated property insights mean faster reviews and fewer site visits; insurers move from submission to decision in record time (Davies Group). Vexcel’s Elements AI supports this by applying machine learning to its detailed, accurate imagery for more reliable AI-derived outputs on properties, greatly improving underwriting workflows.

Instead of chasing down field reports or relying on outdated inspections, underwriters can see roof material and condition, building footprints, defensible space, or other key attributes like pools and trampolines quickly. That efficiency translates to more submissions reviewed each day—and more opportunities won without sacrificing accuracy.

Closing the Premium Leakage Gap

Premium leakage occurs when underwriters fail to charge appropriately for actual risk. From incorrect square footage to undisclosed renovations, small inaccuracies add up fast. Vexcel’s data closes this gap by:

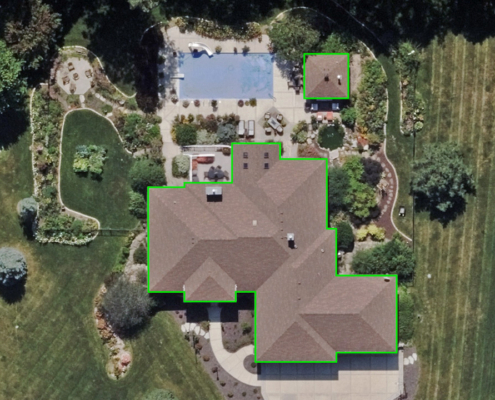

- Measuring buildings footprints with ortho imagery

- Detecting additions or outbuildings through oblique views

- Flagging risk indicators like deteriorating shingles or overhanging trees with AI-driven analysis

By aligning premiums with true property conditions, underwriters protect profitability and keep portfolios healthier.

Submissions Informed by “What If”

Great underwriting isn’t just about today, it’s about anticipating tomorrow. Vexcel’s Gray Sky program, which captures imagery after major natural disasters (tornadoes, hurricanes, wildfires), gives underwriters an evidence-based perspective on how properties withstand stress.

For example, imagery from a hurricane-prone region might reveal roof types that fare better or neighborhoods with repeated flood impacts. Incorporating this intelligence at submission helps insurers price risk with greater confidence and avoid surprises down the road.

Context Through History

A single snapshot shows what is true today but underwriters need to see what happens over time. Vexcel’s historical library, often with multiple refreshes in urban areas, supports the ability to evaluate whether a property is being maintained, upgraded, or slowly deteriorating.

This long view is invaluable. A roof that appears fine today but has shown repeated patchwork repairs across years may carry higher risk than a newly installed roof. By layering context onto submissions, underwriters make decisions that are smarter—and more defensible—than those based on paperwork alone.

In Conclusion: The Underwriter’s Advantage

With Vexcel, underwriters gain measurable wins:

- Faster submission reviews by removing the need for site visits and reducing manual data checks

- Reduced premium leakage, addressing billions in lost revenue across property lines from misclassified or missed risk details

- AI-driven insights that surface property attributes—roof condition, additions, vegetation—that are often missed in submissions

- Historical and disaster data that provide context and evidence to back underwriting decisions

Underwriting doesn’t have to be a guessing game or an administrative grind. With the right data at their fingertips, underwriters can move from submission to smart decision faster than ever before.