Managing Risk with Clarity: Spot Distressed Assets Early

For mortgage banks and portfolio managers, risk management comes down to one thing: visibility. With thousands of properties spread across multiple regions, it’s hard to know which ones need attention today and which might tomorrow. A recent report on foreclosure activity underscores the urgency. In Q1 of 2025, nearly 94,000 U.S. properties had foreclosure filings, up more than 11 percent from the previous quarter. Numbers like this show why spotting early signs of distress matters so much. The faster you can identify properties that may be at risk, the more opportunities you have to intervene, protect asset value, and support borrowers before issues escalate.

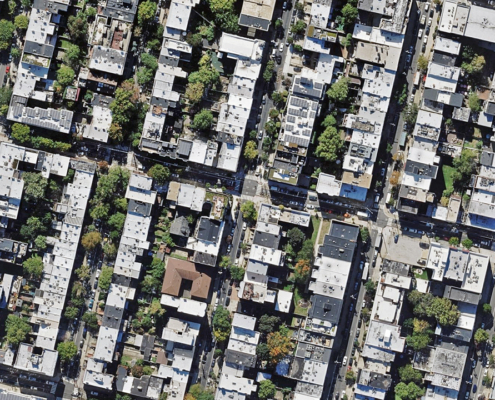

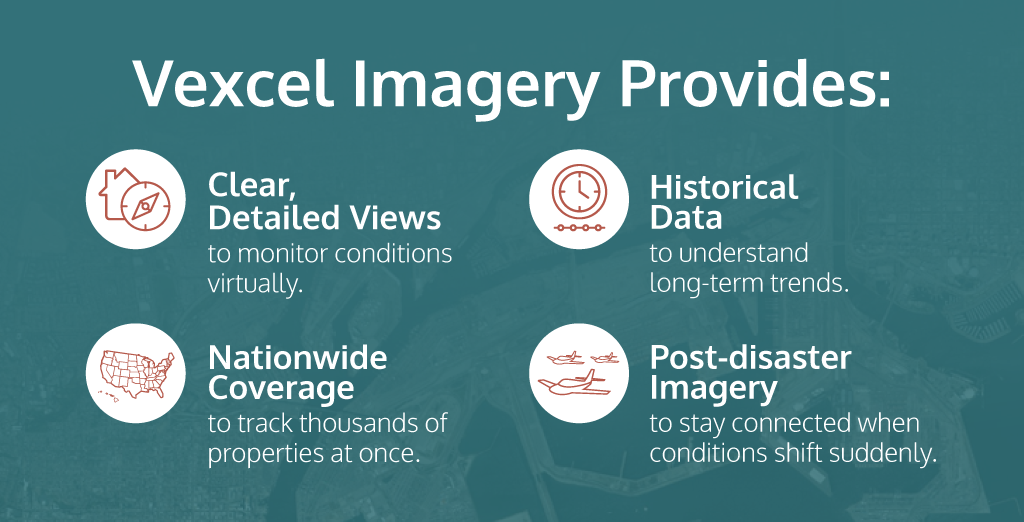

Vexcel’s high-resolution aerial imagery helps address this problem. With broad U.S. coverage and a deep historical library, it equips you with clarity, consistency, and speed to manage portfolios more confidently.

See the Signs Before They Spread

Distressed assets rarely appear overnight. The first signals are small: a roof in need of repair, an overgrown yard, or a property where updates are not being maintained. Multiply that across thousands of homes and the challenge is clear.

Vexcel imagery makes it simple to spot these early indicators at scale. Instead of waiting for missed payments or incomplete reports, managers can see conditions directly and take proactive steps. The result is fewer surprises and healthier portfolios.

Confidence at Scale

Field inspections will always matter, but they cannot keep up with the scale of large portfolios. And when it comes to evaluating thousands of properties? Vexcel imagery fills that gap, providing consistent views across cities, suburbs, and rural areas.

Having access to clear, current imagery helps teams prioritize where to send inspectors and where virtual review is enough. That saves time, reduces costs, and helps focus resources where they will have the biggest impact.

Clarity After Disasters

Storms, floods, and wildfires create uncertainty not just for homeowners but for the financial institutions that serve them. Knowing which properties are on the path to recovery and which may stall is critical.

Vexcel’s Gray Sky program delivers detailed post-disaster imagery quickly after an event such as a wildfire, tornado, or hurricane, so managers can assess damage, support borrowers, and understand risk quickly. This kind of timely clarity turns confusion into informed action. It can also help identify properties not being rebuilt after a disaster, potentially raising a red flag on risk to a mortgage.

The Power of Historical Context

Looking forward is easier when you can also look back. With Vexcel’s historical archive, portfolio managers can see how a property has changed over time. Has property upkeep been consistent? What about any value added through improvements like increased footprint, decks, or pools? Or are there patterns of neglect?

That long-term perspective helps confirm trends and validate decisions with confidence.

Turning Risk Into Readiness

Every portfolio carries risk, but it does not have to be a guessing game.

Why it Matters

For portfolio managers, the question is not if distressed assets will appear, but when. The key is being ready. With Vexcel imagery, you are not reacting in the dark. You are equipped with the visibility to spot early warning signs, support recovery after disasters, and strengthen the health of your entire portfolio.

That is the kind of foresight that protects investments, reduces uncertainty, and ultimately delivers better outcomes for both institutions and homeowners.

See how Vexcel can support your portfolio management strategy. Explore our Financial Services solutions or request a demo today.