Unmasking Fraud in Property Claims: How NICB and Vexcel Illuminate the Truth

Vexcel collaborates with the National Insurance Crime Bureau (NICB) to support enhanced fraud detection

Insurance fraud in the property and casualty sector is a serious concern and can put a significant strain on the economy. The Coalition Against Insurance Fraud estimates that 10% or more of property-casualty insurance claims may be fraudulent. Even more striking, a survey for insurers (conducted by the Coalition Against Insurance Fraud) reports that 75% of respondents observed an increase (either significantly or slightly) in fraud over the prior three years–an 11-point jump–highlighting a growing and persistent challenge.

Fraud is the second most costly white-collar crime in America after tax evasion, underscoring the enormous impact on the insurance ecosystem. It’s one reason why the NICB, and insurers, are looking for additional resources, including recent imagery, to improve their ability to detect fraud.

NICB: The Investigation Powerhouse

The NICB serves as a central hub in the battle against insurance fraud and property-related crime. Supported by more than 1,200 property and casualty insurers, it leverages intelligence and analytics to deliver key data that can support law enforcement investigations. In addition, their Catastrophe Response Team aids in fraud detection by mapping claims data and sharing details on recover efforts.

But what they also leverage is high-resolution aerial imagery from Vexcel, especially when it comes to using Vexcel’s Gray Sky disaster imagery.

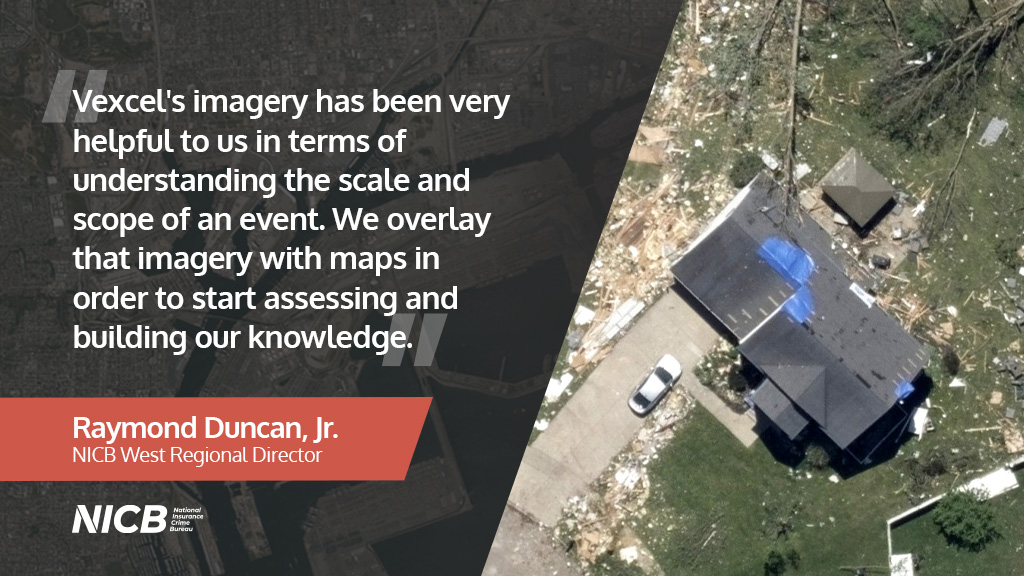

“Vexcel’s aerial imagery has been very helpful to us in terms of understanding the scale and scope of an event, like the recent LA wildfires,” shared NICB West Regional Director Raymond Duncan, Jr. “We overlay a lot of that imagery with maps in order to start assessing and building our knowledge.”

The Gray Sky Advantage: Vexcel’s Disaster Response Program

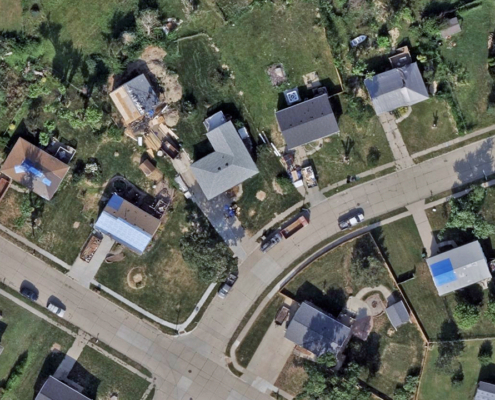

After a major catastrophe such as a hurricane, tornado, or wildfire occurs, Vexcel initiates a response through their Gray Sky program. Planes are positioned around the U.S. and able to respond as soon as thresholds are met and skies are safe to fly in.

Vexcel has been responding to disasters since Hurricane Harvey in 2017 and delivers high-resolution aerial imagery for NICB and insurer partners to access for property damage assessment. It’s this critical piece of data that has assisted NICB in combatting fraud up front.

NICB interacts with Vexcel frequently for catastrophic weather events, typically getting notified by Vexcel if an event is being flown. Once that data is collected, processed, and published, the NICB team begins reviewing imagery to start understanding impact.

“What we’ve found so beneficial is the presentation of Vexcel’s data, not just for the current disaster, but also the historical flyovers where we can evaluate imagery collected a year before the event,” commented NICB’s Catastrophe Program Director, Robert Bornstein. “We take the images from the event itself and get this ideal side-by-side comparison. It’s this type of data we can put next to a claim to validate and verify what’s happening. It’s extremely valuable intelligence for us.”

Questionable Claims Supported by Aerial Imagery for Fraud Detection

NICB serves as a critical link between insurance companies and law enforcement agencies. Keeping this collaboration strong involves a lot of information sharing, made easier with Vexcel’s imagery and data.

“We rely on our member companies to send us questionable claims and then we conduct a further investigation to determine if there is actual fraudulent activity,” said Duncan.

“And this is where Vexcel’s value comes into play, it’s in those investigations,” shared Bornstein. “If an investigation is opened, we use our comparison data to determine if the need is there to further an investigation.” Examples would be using aerial imagery to support the conclusion property was damaged, like a deck being destroyed or roof being damaged, when in reality, the opposite was true. “It’s these types of pieces of information that really support us when we need to investigate a claim.”

AI Takes Claims Investigations to the Next Level

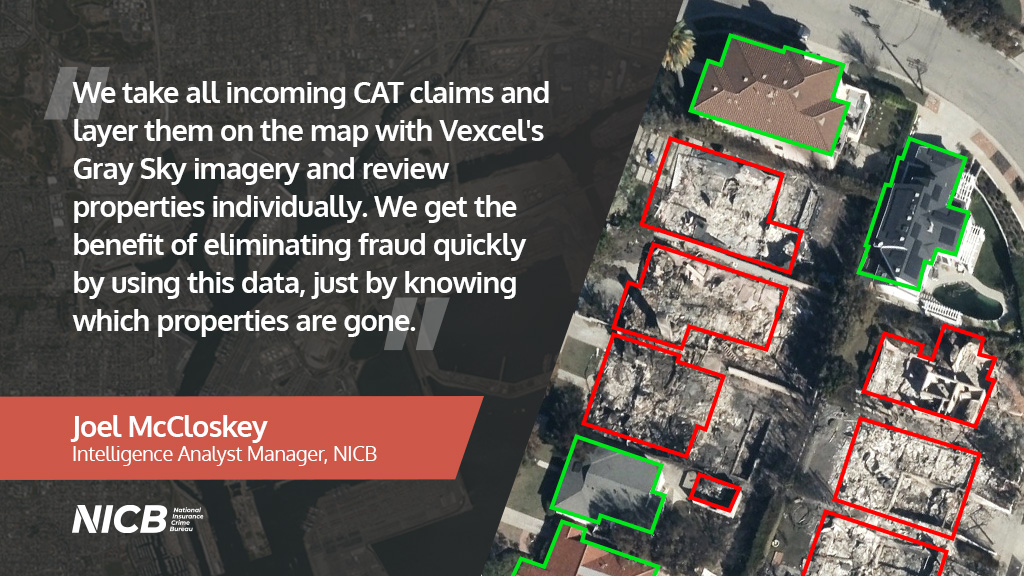

Beyond just the imagery, NICB is also using Vexcel’s AI-derived Damage Assessment information to quickly knock out areas of concern. After an event, Vexcel delivers damage footprints over affected areas so end users can see in seconds what the real impact is to properties.

Joel McCloskey leads NICB’s analytical CAT response team which relies heavily on this information. “We take all incoming CAT claims and layer them on the map layer with Gray Sky imagery and look individually at properties. We get the benefit of eliminating fraud quickly by using this data, just by knowing which properties are gone.”

His team can review an entire area and use the Damage Assessment layer to weed out the properties identified in red which indicates severe damage, often a completely destroyed property. Just that bit of data alone saves time in determining the potential for fraud.

Bringing it All Together: NICB + Vexcel

Insurance fraud in property claims is a challenge with large-scale implications for costs on the industry. But when you combine:

You get a partnership that empowers insurers to act decisively and ultimately protect policyholders and reinforce trust in the claims process. Verify property conditions in seconds, assess damage, and identify discrepancies in claims using visual evidence and AI insights. Spot fraud faster with Vexcel and NICB.